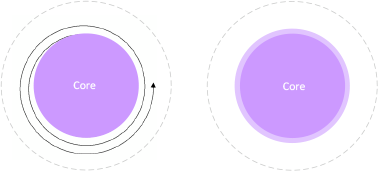

Enterprises are designed to execute a repeatable and scalable business model whereas startups are designed to search for a repeatable and scalable business model.

Since the core business model(s) are known for an enterprise, they already have product-market-fit, distribution channels, revenue model, the cost to deliver, financial metrics, job titles/responsibilities and so on. Due to the knowns, failure to meet a goal, revenue, product delivery, service, etc – is a failure in execution of an individual and/or organization to perform to a known set of success criteria. Enterprises also have policy, procedures and structures that make them efficient execution machines.

Startups have finite time and resources to find product-market-fit before they run out of money. Therefore they trade off certainty for speed, adopting a minimum viable approach, iterating and pivoting as they fail, while learning and discovering their business model. Due to this startups have speed, urgency, agility, low-cost, rapid experimentation and high chance of innovative disruption as an advantage.

An Enterprises can accelerate its organic-growth by adopting startup practices (lean methodology) but to really be innovative, it needs to build a “startup within an enterprise”.

This post provides a high level concept that can be used to build a system/structure for building a “Startup within an enterprise”; the Enterprise it targets is large to very larger where the enterprise has several verticals and each vertical has several business units that collectively contribute to the enterprises EBITA.

Innovation within an Enterprise

In a nutshell, there are two ways enterprises can foster innovation:

- Strategic: Create an innovation lab/team, and/or

- Ad-hoc: Jump-start it

Strategic: There are several examples of enterprises that have built innovation labs/team; GE, Intuit, HP, P&G, Xerox, Coca-Cola, Fidelity, Google – to name a few. These enterprises made a strategic decision to build out such innovation labs as part of their core that required a varying mix of new organizational structures, new hires and substantial investments.

Ad-Hoc: There are also examples of enterprises that take and ad-hoc approach and “jump-start” innovation with the help of hack-a-thons, 20% time, 1 week per quarter, offsite camp, cash-prize; Google, MIT, Harvard are some that frequently run these programs .

One of the biggest challenges with innovation within an enterprise is “culture”. It’s interesting to note that most enterprises that have a lab/team (strategic innovation) also run ad-hoc innovation programs – this allows them to have a focused delivery of innovation and also have an organization wide culture that supports and encourages ideation, innovation and execution of ideas.

It will be more challenging for an enterprises that only run and rely on ad-hoc innovation programs to be successful with innovation as innovation becomes a “part-time” effort.

It’s important for an enterprise to have a team that focuses on innovation as a “full-time strategic” activity and not as a “part-time ad-hoc” effort in order to have a greater chance of success with innovation – here is why: 75 % of venture-capital-backed start-ups fail; and 50% of backed start-ups make it to their 4th year. These startups, usually consist of dedicated entrepreneurial teams trying to build something, spending 100% of their energy, every minute of every hour trying to make it successful – they are in it full time. If a startup’s “full-time” innovation effort has such a low rate of success, what will be the success rate of a part-time effort?

A dedicated team should be created if an enterprise wants to make innovation a strategic effort. If you have no one fully focused on innovation, you’ve decided not to focus on innovation.

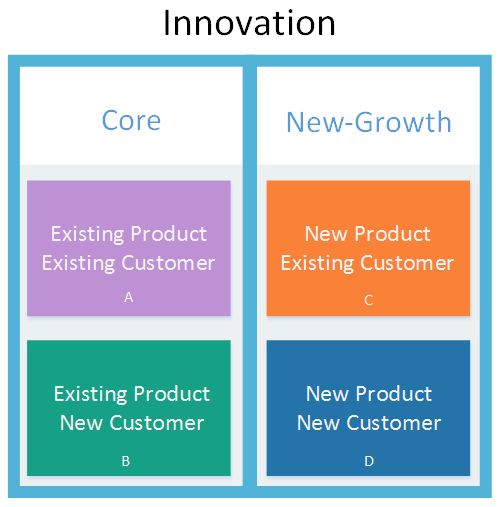

Innovation buckets

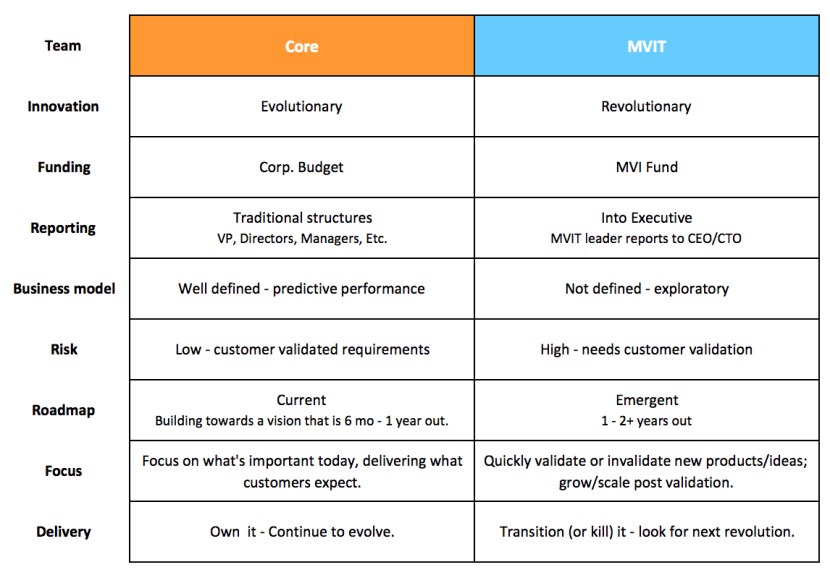

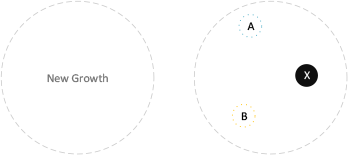

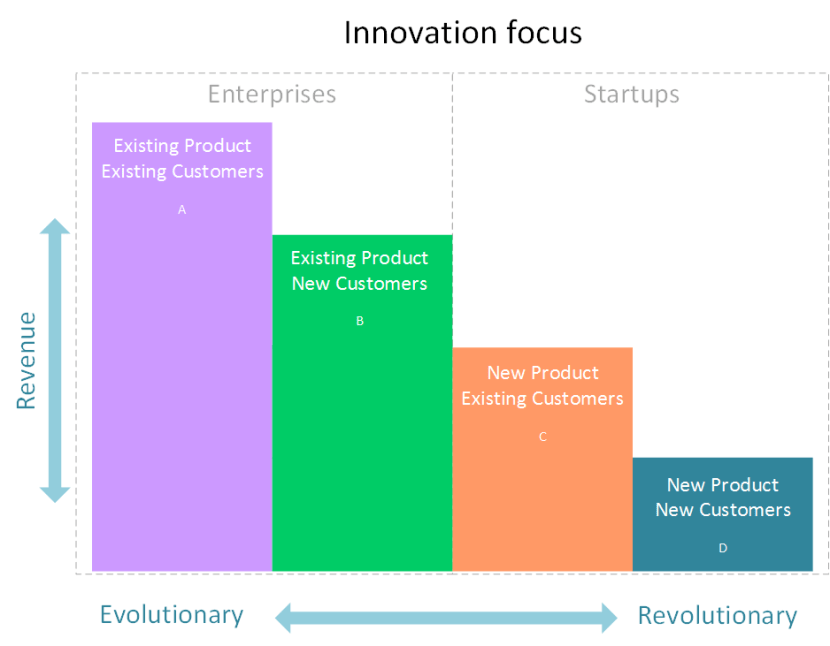

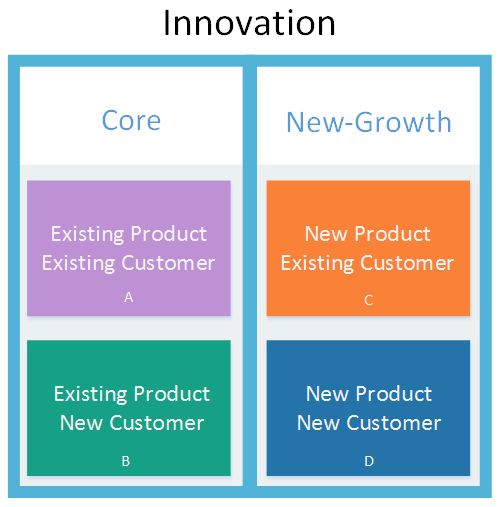

Innovation falls into two main buckets: “Core” innovation and “New-Growth” innovation

- Core innovation: Initiatives focus on enhancing existing product, for existing or new customers; Revenue comes in earlier and the initiative is tied to short-term financial goals

- New-growth innovation: Initiative’s focus on new product/segment/markets/business models for existing or new customers; Revenue takes longer to come in and the initiative is tied to long-term financial goals.

Mind the Gap

There could be various reasons why an enterprise would be looking to improve innovation efforts – a common one is to improve revenue. Almost everyone innovates even when they are not actively trying to improve innovation and that’s because they sit in Box A, where they may change support/maintenance rates, continue down their roadmap enhancing offerings – if they do not, revenue will not grow and may even drop.

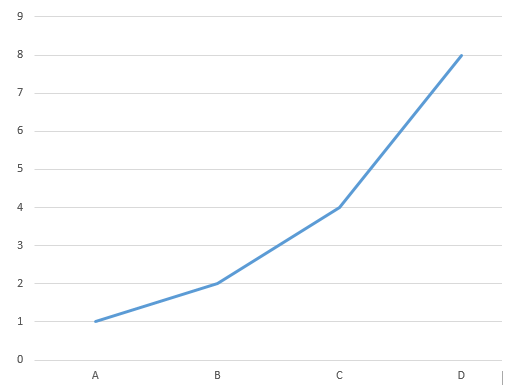

Let’s assume that the organic-growth target is 6%, if the enterprise is sitting in Box A, and only hitting a 3% target, you have a gap and the enterprise needs to figure out how it’s going to get the additional 3%.

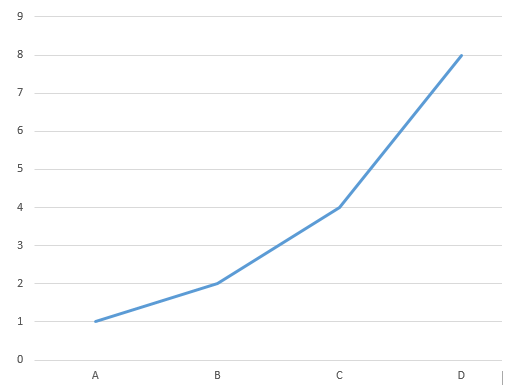

With some luck or heroism they may move to Box B; it’s also possible that the enterprise may be actively trying to peruse the next level of core innovation but this is incremental and the growth will be short-term and will likely only get them an extra point or so helping them grow to a 4% growth.

If the effort to go from each box to the next is a 2x the previous then this is the effort from going from A to D is diagrammed in the following chart:

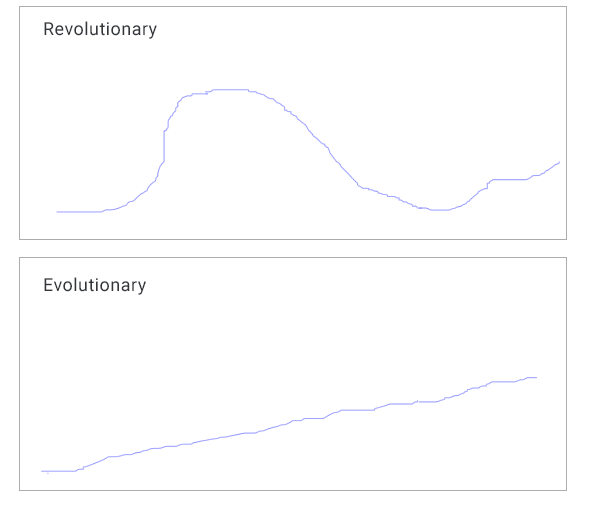

The move from A to D (or even c) is not incremental, it’s disruptive. Most enterprises do not operate in a way that can introduce disruptive innovation to grow, not because they do not want to, but because the core of their business and growth is built on the stability of known, incremental innovation.

Enterprises needed to strategically use new-growth innovation to “bridge the gap” between the target growth rate and what they can get from core innovation.

Focus on Strategic Innovation

In 2000 Proctor and Gamble underwent a massive effort to build an innovation “factory” that helped them increase their success of innovation by 3 times – A “factory” is not what is being proposed here.

There are some simple learnings from the lean methodology that I think should be used as core principles when focusing on innovation efforts, when innovating:

- Validate and build for market – not for one customer

- Do not feed the zombies – recognize failures and fail fast; learning from it.

- Focus on instant gratification, short circuit delivery cycle and getting to the next milestone.

- Recognize that not all opportunities solve problems – some only enhance pleasure.

- Minimum viable “everything”

Keeping the “Minimally viable” point in mind – strategic innovation should fall in the hands of a dedicated team and this dedicated team should be a reflection of this principle, it should be a “Minimum Viable Innovation Team” (MVIT).

The MVIT consists of 2 to 3 individuals that complement each other with the following two skills:

- Be strong in business sense and/or

- Strong in technical skills

One could say that the MVIT is like a “startup within an enterprise”.

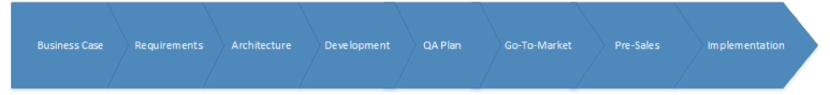

In addition to having dedicated team – we need an orderly, reliable and repeatable process that will give the entire innovation effort a structure and discipline; we will call this the “Minimum Viable Innovation System” (MVIS).

Minimum Viable Innovation System

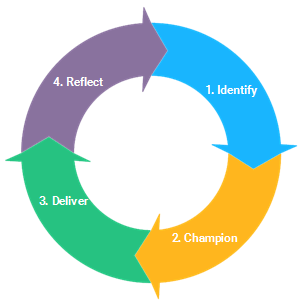

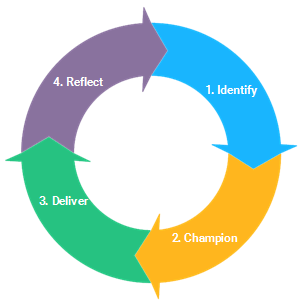

The MVIS is a cycle that repeats itself that has 4 stages: Identify, Champion, Deliver, Reflect

Identify

In this phase the Minimum Viable Innovation Team works to:

- Identify innovation opportunities

- Validate and shortlist innovation opportunities

- Define success/failure criteria

- Obtain (borrow) resources

- Manage/develop/deliver innovation product(s)

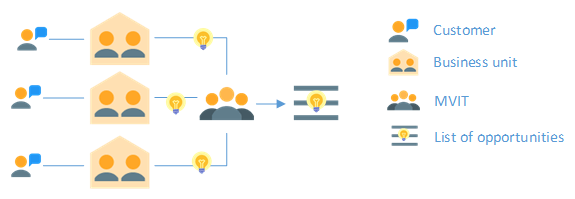

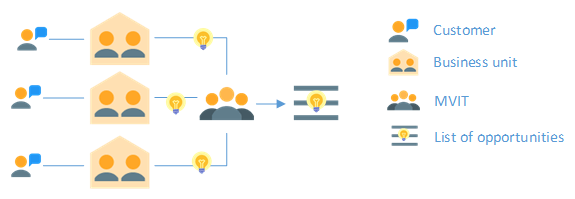

In the above, the MVIT (using lean methodology) will work with business units (or on its own) to identify, validate and define success/failure criteria for every idea. Opportunity identification and validation will be a 1-3 week effort where:

- a few key individuals within a business unit will be identified for the effort

- these individuals will meet several customers and probe for unmet needs;

- They will also look within their BU where innovation opportunities may already be underway but not recognized as a new-growth opportunity (avoid zombies).

For each opportunity that comes out of this effort, it must satisfy at least one of the following:

- it should be a pain point that no one is address well, or

- Something that must be done better due to a legal/regulatory need, or

- It must be something that can be successfully built faster than others because we have a secret sauce that gives us advantage over others.

In addition to uncovering the opportunity, the BU and the MVIT will work on estimating the opportunity potential and the resource need to deliver.

Champion

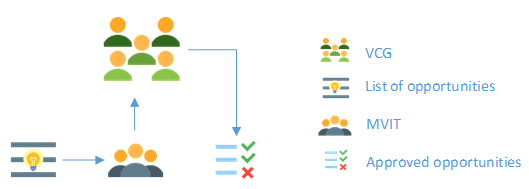

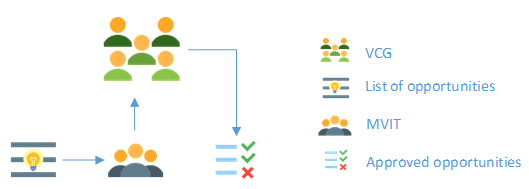

Innovation opportunities come with strategic uncertainty and since the goal is to build an innovation system, we need a team that will keep the MVIT in check by having the autonomy to make decisions about starting, stopping, or redirecting innovation projects. In addition to keeping the team in check, it will also approve/deny budgetary requests for such projects very much like a Venture Capitalists function for startups – we will call this the “Venture Champion Group”.

The MVIT works with the VC group to gain approval.

- When working with the VC group to get approval for an innovation opportunity, the MVIT does not need every VC to approve – it needs just need 1 who deeply believes in the opportunity.

- Each innovation opportunity should have a threshold investment amount that the MVIT can spend without asking for approval; i.e. 20k of a 500k approved budget for an innovation opportunity.

- As the opportunity and innovation delivery progresses – the team may run into a need for a break-risk investment where additional investment may be needed to get over a risk; i.e. a public cloud based MVP was being built with a $50k approval, however there is now a need to have the MVP on a private cloud that makes the infrastructure cost significantly up.

Deliver

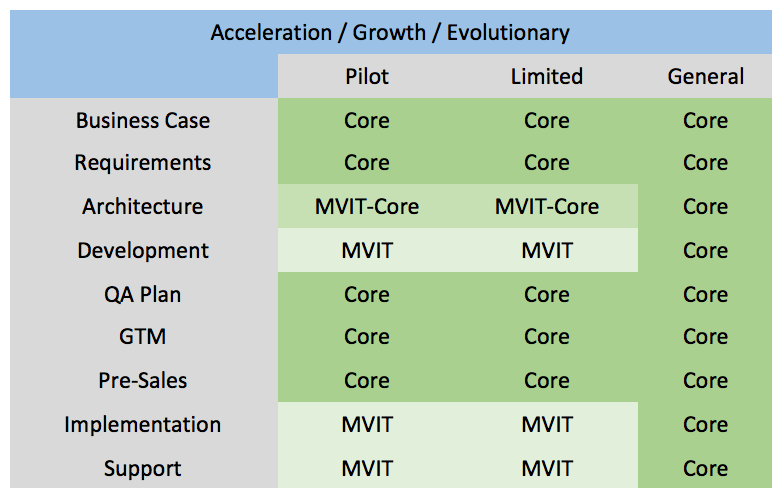

With the approved list of innovation opportunities, the MVIT works with the various BU’s to deliver, again using lean methodology.

During the Identify phase resource needs would have been discussed. Ideally for a MVP the BU and MVIT should look at using existing resources as that drives engagement and builds a culture of innovation. Resources could be from within the BU or from other BU’s who may be interested in building and delivering the opportunity.

Reflect

With each iteration of this cycle – there will be lessons learnt that should be reflected and acted upon. The reason the MVIS is a system is so that there is opportunity to optimize and follow a repeatable process. To build an engaging culture of innovation these lessons, the successes and failures should be shared with others outside who are outside the MVIS; some do this with the ad-hoc innovation effort mentioned earlier

Cost and Revenue

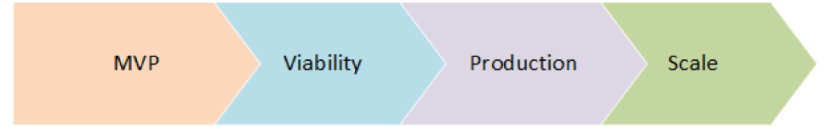

In the startup world, there are various stages of funding and exits: seed, angel, venture, IPO, acquisition, etc. A startup within an enterprise will likely not run into those, but that doesn’t mean we cannot learn from them and model our cost & revenue after them.

MVI Fund

Creating a MVIT is a strategic decision and will require some sort of fund allocation to cover the salaries of the 2-3 person team; in addition to the salary, the enterprise should consider a sizeable amount it is willing to risk. Since both the activities: creating a dedicated team and investing in opportunities are risky, we can put the cost of both of these in the fund. If the salaries of the team require $500k / year and the enterprise wants to invest in 10 innovation opportunities each year at an average $100k per opportunity, the allocation of the fund needs to be at $1.5M / year, where $1M can be a variable expense but the $500k is fixed.

A simple way to fund the MVI Fund is to split the cost among all the BU’s, or depending on the BU’s own size, you could formulate a MVI Fund contribution amount; i.e. the fund contribution shouldn’t be the same for a BU that generates $10M / year vs. a BU that generates $60M / year.

There are other options as well, such as allocating the funding as an investment but that then goes into more complicated accounting methods.

Failure Hit

When an idea fails, the investment is lost, the following points should be considered to understand who takes the hit.

- The MVIT is mostly responsible for building/delivering the opportunity; the BU rides shotgun

- MVIT works with the approved allocation for an opportunity from the MVI Fund; i.e. additional resources are needed

So when an opportunity fails the BU does not (directly) take a hit, the fund does.

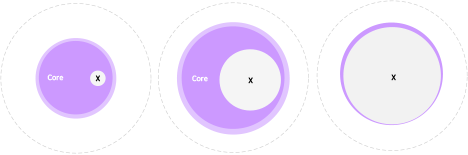

Success

It is the MVIT that is building the MVP and supporting the product as lean as possible; it should be able to support 1-2 customers with shared front line resources from the BU that has the domain knowledge. Once the opportunity is ready for larger market adoption, its ownership/management is moved from the MVIT to the BU, where the BU buys the opportunity from the MVIT. The following points can help illustrate the terms of the transaction and where the revenue is assigned.

- MVIT builds MVP, revenue target to exit MVP is $500k, at a cost of $100k

- MVP brings in some revenue, 100% revenue assigned back to fund

- MVP hits $500k, reached 2 customers, it’s not ready for Market/post MVP

- BU “buys” 90% of the opportunity for $200k (2x cost);

- Opportunity continues to bring in revenue, 90% assigned to BU, 10% assigned back to fund.

This allows the fund to organically-grow and have a return on the investments made by the fund.

Why? – Because its not easy.

The reality of innovation is that it only sounds easy – but it is not. Startups make it seem easy to innovate, and for them it is natural. Enterprises on the other hand just don’t seem to be very innovative.

“Empty your mind, be formless, shapeless — like water. Now you put water in a cup, it becomes the cup; you put water into a bottle it becomes the bottle; you put it in a teapot it becomes the teapot. Now water can flow or it can crash. Be water, my friend.” – Bruce Lee

Startups can be water, but enterprises with their structures, metrics, measurements and financial discipline cannot.

The MVIS along with the other pieces allows an enterprise to build a hybrid model where you can benefit from the strengths of both so that you can have the discipline of an enterprise but also have the fluidity of a startup. The MVIS allows you to have an engine that brings with it some repeatability and opportunity for optimizations.

A major challenge that enterprises have is “culture”, specifically “innovation culture”; changing an enterprise culture is a long-term commitment. At the end of the day, everyone needs to be responsible for innovation, you cannot have just 1 team lead innovation efforts and not have a culture around it and likewise, you cannot have a culture around innovation that will give you the growth needed if you do not have a team focused on the effort.

The main reason enterprises fail at innovation is because they simply do not recognize the long-term cultural and strategic effort needed to become “innovative”; The MVIS helps put a framework in place that an enterprise can build upon.

Credit

This post borrows and builds upon ideas/concepts from various sources:

- The lean enterprise – Trevor Owens

- Works from Innosight

- It heavily borrows and builds on the post from Scott Anthony

- Concepts from Steve Blank

- Cool icons for some diagrams by icons8.com